While buying a home can be an exciting journey, you must first deal with closing costs before getting the keys to your dream house.

Closing costs are the related fees and expenses buyers or sellers pay before closing a real estate transaction. So, while planning for your mortgage, you must familiarize yourself with how much closing costs are in Louisiana and what fees are included to prepare yourself financially.

Photo by Ian MacDonald on Unsplash

Who pays closing costs in Louisiana? The buyer and seller are responsible for shouldering closing costs, with each party having its own fees to pay.

Sellers closing costs in Louisiana are typically higher than the buyers’ because they also need to pay a commission to a realtor. On the other hand, the buyer pays most fees associated with mortgage and documents.

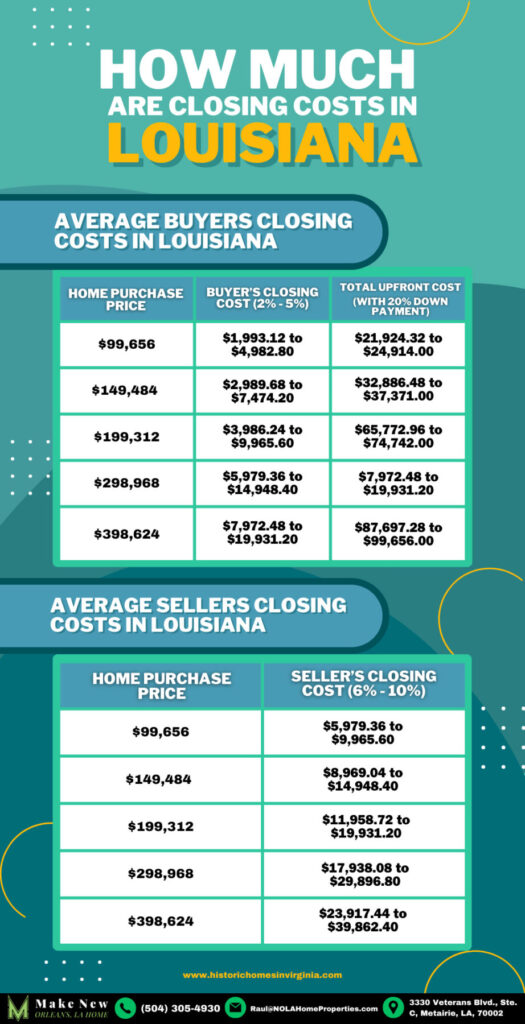

Buyers are expected to pay at least 2% to 5% of the home’s agreement value, while the sellers are expected to pay around 6% to 10%.

To put it in a number, below is the amount you can expect on how much closing costs are in Louisiana, based on the current average home value in the state, amounting to $199,312 as of November 2023.

Buyers

| Home Purchase Price | Buyer’s Closing Cost (2% - 5%) | Total Upfront Cost (With 20% Down Payment) |

|---|---|---|

| $99,656 | $1,993.12 to $4,982.80 | $21,924.32 to $24,914.00 |

| $149,484 | $2,989.68 to $7,474.20 | $32,886.48 to $37,371.00 |

| $199,312 | $3,986.24 to $9,965.60 | $65,772.96 to $74,742.00 |

| $298,968 | $5,979.36 to $14,948.40 | $7,972.48 to $19,931.20 |

| $398,624 | $7,972.48 to $19,931.20 | $87,697.28 to $99,656.00 |

Sellers

| Home Purchase Price | Seller’s Closing Cost (6% - 10%) |

|---|---|

| $99,656 | $5,979.36 to $9,965.60 |

| $149,484 | $8,969.04 to $14,948.40 |

| $199,312 | $11,958.72 to $19,931.20 |

| $298,968 | $17,938.08 to $29,896.80 |

| $398,624 | $23,917.44 to $39,862.40 |

Now, let’s break down the different fees that make up the closing cost in Louisiana. The closing costs are identified into 5 categories, namely the Purchase Price-Related Costs, Loan-Related Costs, Legal and Administrative Costs, Prepaid Expenses, and additional costs.

Purchase Price-Related Costs

Photo by Naomi Ellsworth on Unsplash

Property Appraisal Fee

A property appraisal is a process through which a real estate appraiser determines the home’s fair market value.

It assures the buyer and the lender that the price the buyer agreed to pay is reasonable. A property appraisal is also used to determine property taxes; thus, this is one of the essential requirements in some states like Louisiana.

The mortgage lender orders the appraisal fee, so the homebuyer pays it, and it is one of the components of the buyer’s closing costs.

Louisiana is one of the most expensive markets for an appraisal, along with Mexico, Oregon, Washington, and Idaho.

The fee for full appraisal varies, depending on several factors, but in general, you can expect to pay around $250 or higher, with Louisiana having an average fee of $350.

As mentioned, the fee will vary due to some factors, including the property type. Below is a helpful guide to the average cost of appraisal fees based on property type in Louisiana and the factors that may influence home appraisal costs.

Average Appraisal Fees

| Property Type | Average Fee Range |

|---|---|

| Single Family Home (Standard Loan) | $300 to $400 |

| Single Family Home (FHA/VA Loan) | $300 to $900 |

| 2 unit Multi-family Home | $600 to $1,500 |

| Apartment | $1,500 to more than $3,000 |

| Condo | $300 to $500 |

Factors that Influence Home Appraisal Cost

| Property size | The cost for an appraiser to assess a larger property is expected to be higher. |

| Needed repairs | Expect to pay more for property appraisal when a home has extensive damage because it requires extra effort on the appraiser’s part. |

| Amount of comps | Suppose the home is secluded or has unique features and fewer comparable properties are available. In that case, the appraiser may impose a higher fee to account for the extra time required for assessment. |

| Seasonal conditions | There are some specific times of the year when you will have to expect to pay more. Some conditions make it more challenging for the appraiser to access the property. |

It is also worth knowing that the appraisal fees for urban and suburban properties are different, as they tend to be higher for rural properties.

Home Inspection Fee

Photo by ThisisEngineering RAEng on Unsplash

Home inspections are vital to see any potential issues with a home and help future homeowners decide if the house is worth the investment. When problems arise during home buying, the property’s home value may decrease or stop the buyer from buying it.

When getting a home inspection, the fees vary, from as low as $75 to more than $1k, depending on the property size, location, and type of home inspection. Louisiana has an average cost of $425 to $475 for a home inspection.

There are two types of home inspections: general inspections, which involve an overall examination of the property, and specialized inspections, which focus on a specific aspect in-depth.

Below are the expected fees for general and specialized inspections in Louisiana:

General Home Inspection Price Range

| Property size | Cost For Home Inspection |

|---|---|

| Less than 1,000 | $242 |

| 1,001 to 1,500 | $280 |

| 1,501 to 2,000 | $290 |

| 2,001 to 2,500 | $307 |

| 2,501 to 3,000 | $323 |

| 3,001 to 3,500 | $338 |

| 3,501 to 4,000 | $365 |

Specialized Home Inspection Price Range

| Type of Inspection | Cost for Inspection |

|---|---|

| Foundation Inspection | $300 to $1,000 |

| Garage Inspection | $200 to $600 |

| Roof | $75 to $200 |

| Exterior Walls | $200 to $800 |

| Septic Tank | $200 to $900 |

| Electrical | $150 to $200 |

| Plumbing | $180 to $225 |

| Kitchen | $200 to $400 |

| HVAC | $100 to $400 |

| Lead-based paint | $250 to $700 |

| Termite | $230 to $930 |

| Mold | $200 to $1,000 |

| Chimney | $300 to $600 |

| 4-point Inspection (HVAC, roofing, plumbing, and electrical systems.) | $50 to $150 |

It is recommended to consider getting a home inspection when buying a home to avoid spending more down the road.

Credit Report Fee

Photo by Gabrielle Henderson on Unsplash

In Louisiana, companies charge $10 to $100 for credit reports.

Another worth noting is that Louisiana is a community property state. Therefore, If you are currently married or not legally divorced, a joint report is required unless you want a conventional loan, and the cost for a single borrower and joint report is different.

When you pay for the credit report, you allow the lender to access and review your credit report for credit score verification. The lender will review the credit report through Experian, TransUnion, or Equifax.

Loan-Related Costs

Photo by Money Knack, www.moneyknack.com on Unsplash

Loan Origination Fee

Loan Origination Fees are up-front fees paid to lenders by borrowers to process a loan application. It covers a significant percentage of how much are closing costs in Louisiana for buyers.

The overall cost varies based on the loan value, but you can expect it to be around 0.5% to 1.5% of the loan value. For example, if you were approved for a $472,030 mortgage. Then, your loan origination fee would be around $2,360 to $7,080.

Discount Points

Discount points are prepaid interest included in the buyer’s closing cost. Each time you purchase a point, it lowers the interest you’ll pay over the life of the loan.

One discount point represents 1% of the loan value. So again, if you have a $472,030 mortgage, a discount point would cost you $4,720.

Points are negotiable; whether you want to buy or how many points you plan to buy is up to you. For Borrowers, getting discount points helps lower the payment during the loan lifespan, but note that it will only be helpful if you keep that mortgage for a long time.

If you think you might sell the house or change your mortgage before completing a mortgage with a long lifespan, paying less upfront for discount points and accepting a slightly higher interest rate might be better.

Mortgage Insurance Premium

Mortgage Insurance Premium is required when borrowers take home loans backed by the Federal Housing Administration (FHA).

Lenders require Mortgage Insurance premiums to protect themselves if the borrower can’t repay their home loans. Since FHA is a government-backed loan, you need to pay an upfront and yearly mortgage insurance premium, no matter how much is the down payment.

| Upfront Mortgage Insurance Premium | Yearly Mortgage Insurance Premium |

|---|---|

| One-time payment is equal to 1.75% of the loan amount, regardless of loan-to-value. | A regular fee is included in each monthly mortgage payment. |

| It can be paid at closing or rolled into the cost of the loan. | The cost of monthly MIP will depend on the size of a loan’s down payment. For a down payment between 3.5% to 5%, 0.85% of the loan amount is divided by 12 Down payment of 5% or higher, 0.80% of the loan amount is divided by 12 |

| If upfront fees were rolled into the loan, the amount wouldn’t count toward the loan-to-value or FHA loan limit. | The payment duration for the annual mortgage insurance premium depends on the down payment amount. If the down payment is less than 10%, it will last throughout the life of the loan (until it’s sold, paid off, or refinanced) If the down payment is 10% or more, it will last 11 years. |

Legal and Administrative Costs

Photo by Thomas Lefebvre on Unsplash

Attorney’s Fees

Getting an attorney is optional in Louisiana, but hiring one can be very helpful when you need someone to draft a real estate purchase contract in Louisiana or other paperwork.

Real estate attorneys in Louisiana charge hourly or work on a fixed fee basis. It can cost around $140 to $350 hourly, with an average rate of $317 per hour.

Title Search and Title Insurance

Title search fees are required when hiring a title company in Louisiana to analyze the property’s ownership record. They will examine public documents like deeds, tax liens, land records, etc., to check for issues. Title search costs $60 to $200 in Louisiana.

In case of a problem related to the title of the property, the lender will require the borrower to get title insurance to help pay to solve the problem. In Louisiana, title insurance’s overall cost depends on the property’s sale price and is charged $7.61 per thousand.

Recording Fees

The recording fee is another component of closing costs in Louisiana to update the ownership records. The price will vary, depending on the county, but you can expect it will cost around $120 to $310.

Prepaid Expenses

Photo by Towfiqu barbhuiya on Unsplash

Property Taxes

Owning a property in Louisiana comes with responsibility regarding property taxes. The good thing about Louisiana is its low property tax with median property tax, making it ideal for property investment.

In Louisiana, property taxes follow an annual schedule and are overseen by the Louisiana Tax Commission. Property tax fees depend on assessed value and your local area or district’s specific rate.

Calculating Property Taxes

As state law dictates, the property’s assessed value is 10% of the fair market value. So, if your property is valued at $300,000, the assessed value is $30,000.

Afterward, the assessed value will be multiplied by the tax rate. There are two ways to express tax rates in Louisiana.

Note that the property tax amount would be the same regardless of which one is used.

The first one is the Millage rate. It is the tax you pay for every $1,000 your property is worth. Again, if the assessed value is $30,000 and your area’s tax rate (millage rate) is 50, you will pay $750 in property taxes. Here’s how you calculate it:

= $30,000 (assessed value) ÷ 1000 = $30

= $15 x 50 (mil rate) = $1500

The second one is the effective property tax rate. It’s the tax you must pay based on a certain percentage of the property’s market value. So, if the local effective tax rate in your area is 0.5% and your property is valued at $300,000, your taxes owed would be $1,500.

$30,000 (assessed value) x 0.5% = $1500

Homeowners Insurance

Lenders will require buyers to purchase homeowner insurance to protect their investment, which costs $2,600 annually.

The home insurance premium is usually a part of the escrow funds, and you pay it as part of your monthly mortgage bill. The cost will be based on the insurance provider, home value, and the coverage you choose.

Additional Costs

Home Warranty

Either seller or buyer pays a home warranty on their closing cost. It helps them ease the cost of fixing or replacing broken-down systems and appliances.

Here are some of the companies considered highest-rated in Louisiana and the fees they charge for their service. The cost provided below is based on a 2,160-square-foot, single-family home in Baton Rouge, Louisiana, so it would be recommended to contact them to get accurate quotes.

| Company | Monthly Cost | Service Fee |

|---|---|---|

| American Home Shield | $64 to $74 | $100 to $125 |

| Liberty Home Guard | $49 to $60 | $65 to $125 |

| Select Home Warranty | $44 to $48 | $60 to $75 |

| AFC Home Club | $48 to $55 | $75 to $125 |

Survey Fee

A survey fee is charged by the company that will survey the property to confirm the property’s boundaries. The usual range for survey fees is $376 to $745. The average cost is $528, including pulling property records and the surveyor’s travel time fees.

Courier and Express Mail Fees

This fee is charged to transport the mortgage document to and from the parties involved. In Louisiana, courier and express mail fees cost $30 to $50.

Conclusion

Purchasing or selling a home involves understanding closing costs, which is especially crucial when buying or selling homes. Buyers and sellers pay for the closing cost, with buyers expecting to pay 2% to 5%, while sellers pay 8% to 10% of the home’s value.

Knowing these figures is crucial to plan your finances and be ready for any fees needed to pay to close the transaction. Understanding how much closing costs are in Louisiana will also provide a smooth and informed home buying or selling experience.

As you go on a home-buying or selling home journey, armed with this closing cost knowledge, you can easily navigate the closing process.

If you have questions or need assistance, you can book an appointment with us anytime, and we would be more than happy to clarify any of your questions or assist you during your buying or selling process. You can contact our team via the following:

To be updated with the latest happenings, news, and events in Louisiana, you can follow us on our social media channels:

Frequently Asked Questions

1. Are closing costs tax-deductible in Louisiana?

Usually, the only tax-deductible closing costs in Louisiana are those associated with mortgage interest, points, and property taxes. Other closing costs, aside from those three, are not tax-deductible.

2. Are there any grants or programs to help with closing costs in Louisiana?

Of course! You can apply for home buyer loans in Louisiana such as Conventional 97, FHA loan, VA loan, USDA loan, and Louisiana Housing Corporation loans.

If you are a first-time home buyer, you can get help with financing, down payments, and closing costs through the Louisiana Housing Corporation (LHC) Mortgage Revenue Bond programs.

They offer two options: Mortgage Revenue Bond Home (MRB Home) and Mortgage Revenue Bond Assisted (MRB Assisted). There’s also the LHC Market Rate Conventional Program, LHC Market Rate GNMA Program, and LHC Delta 100 Program.

3. Can I negotiate closing costs in Louisiana?

Yes, some of the closing costs are negotiable, whether it is with the lender or seller.

Some might be willing to help you with some of the fees on closing costs, but note that negotiating should benefit both parties. When it comes to lenders, it would be helpful to shop and look around and compare offers from different lenders to reduce closing costs.

4. Can I roll closing costs into my mortgage?

Yes. You can include some of your closing costs in your mortgage loan. However, be aware that not all lenders will allow this, and if they approve, the rules will vary depending on your mortgage type.

Note that when you roll the closing costs into your mortgage, you will pay interest on the closing fees; thus, it will make you pay more for the mortgage in the long run.

5. Do closing costs vary by location in Louisiana?

Yes. Location is one of the factors that affect closing costs in Louisiana.

6. How can I estimate my closing costs?

Buyers can multiply the value of their property by 2% or 5% (0.02 or 0.05) to estimate the closing cost they will have to pay. If you are a seller, you can multiply the home value by 6% or 10% (0.06 or 0.1)